What is a

Card Machine?

A card machine lets your customers pay you by card, wherever you do business. All iKhokha devices work with the free iKhokha App, giving you a simple way to track sales, send receipts and manage everything from one place.

Compare our card machines

Use our comparison table to find the right card machine for your business. Get paid fast, pay less per sale and never worry about monthly fees.

Choose a device that works as hard as you do and start selling smarter.

How iKhokha Card Machines work

Getting started with iKhokha is straightforward:

Choose your device

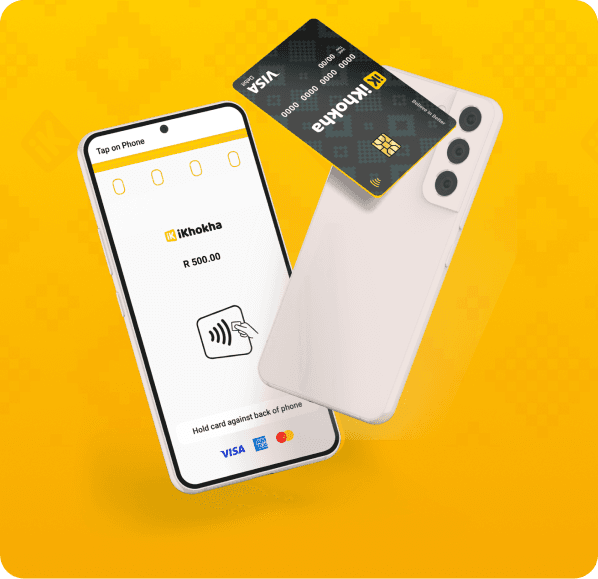

Pick the card machine that suits your business, the iK Flyer, iK Flyer Lite or iK Tap on Phone.

Sign up with iKhokha

Create your iKhokha account online or through the free iKhokha App to start managing your sales and business in one place.

Get verified

Upload your business documents to complete your FICA verification and activate your account.

Start taking payments

Your customers can tap, swipe or insert their cards. All transactions are securely processed by iKhokha.

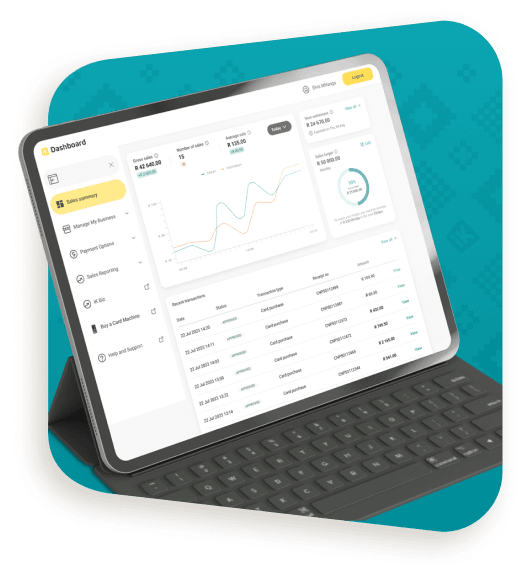

Track your sales

Keep track of every sale in the iKhokha App or on the iK Dashboard. See your transactions, send digital receipts and view your daily totals in real time.

Shop accessories

Find compatible printers, print rolls, stands and tablets.

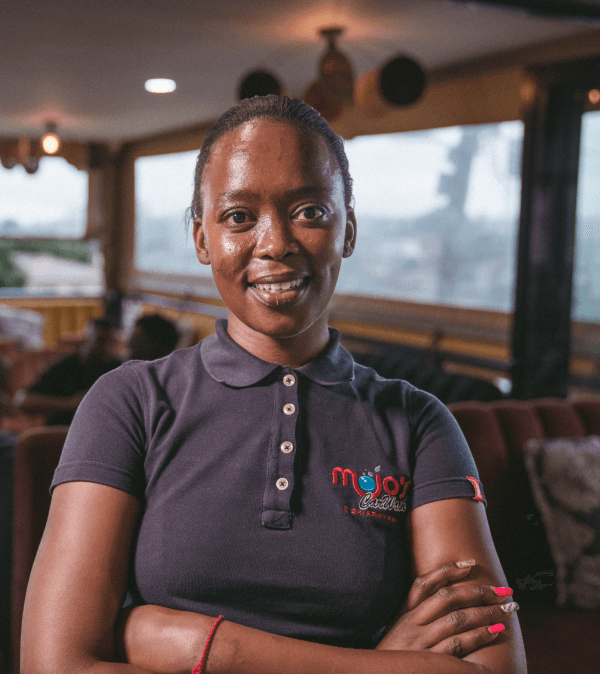

Grow your business your way

Sell airtime, data & prepaid vouchers

Attract more customers by selling airtime, data, electricity & gaming vouchers with iK Prepaid.

Run your business

Track your sales, stock, and invoicing in real-time with insights and analytics to manage and grow your business with iK Dashboard.

Get business funding

You could get up to R1 million in funding after 6 months of trading to boost your business with iK Cash Advance.

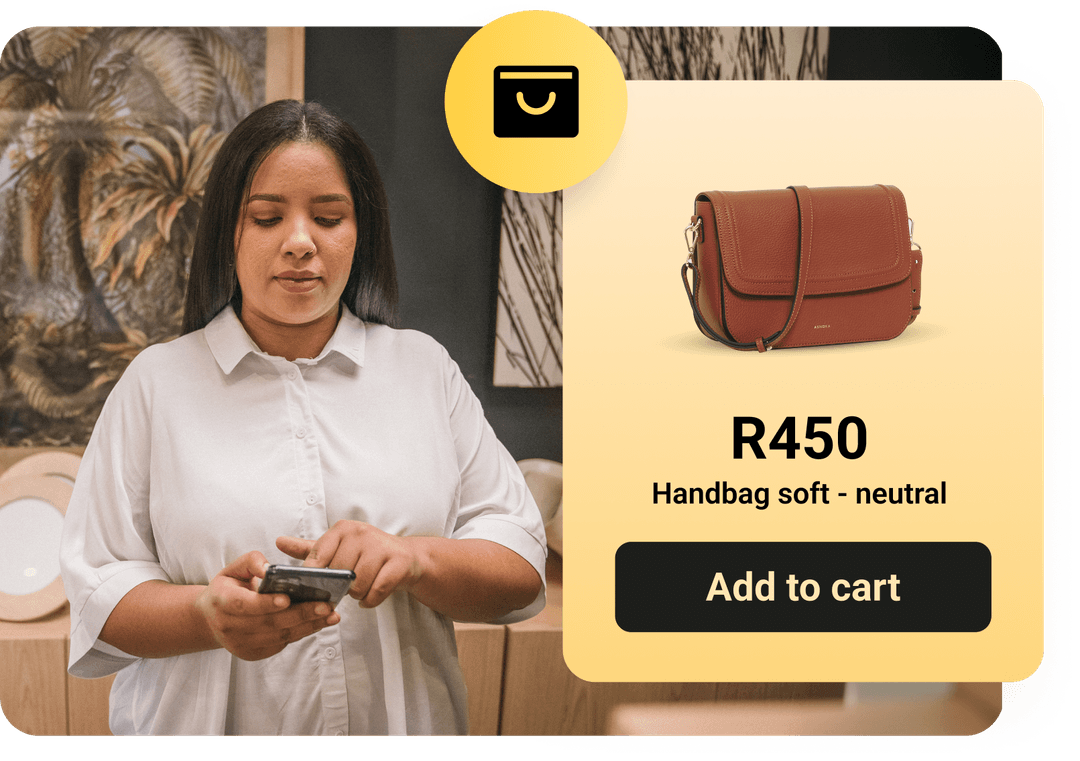

Expand from in-person payments to online

FAQs

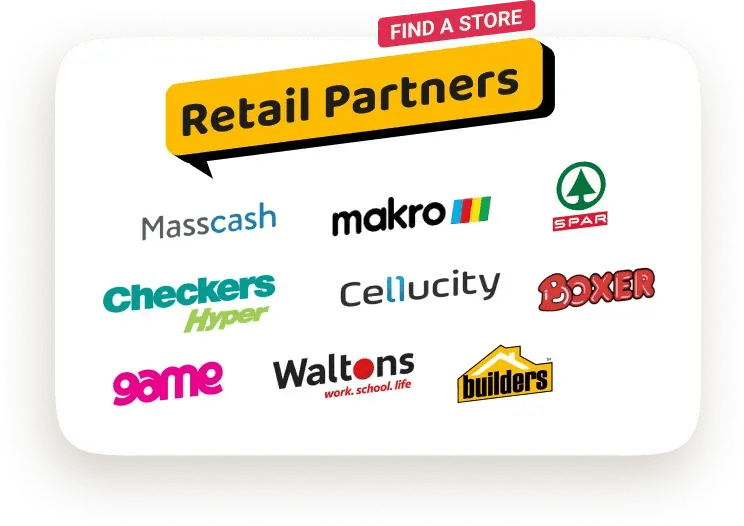

iKhokha devices start from R699 once-off, with no monthly rental fees. You can also get started for free with iK Tap on Phone.

No. You only pay a small transaction fee that gets lower the more you sell. No contracts or hidden charges.

No, you can use your personal account when signing up. A business account simply makes tracking your payments easier.

You can order online in a few minutes. Choose your device, sign up with iKhokha, complete your FICA verification, and we’ll deliver your machine within 3–4 working days.

The iK Flyer Lite is ideal for small businesses, it’s affordable, easy to set up and fully integrated with the iKhokha App.

Yes! With iK Tap on Phone, you can accept contactless payments using only your Android smartphone.

iKhokha card machines use Wi-Fi or SIM data (optional), so you can keep taking payments wherever you are.

Need help?

Get help instantly on WhatsApp, our chatbot Kelly, or by requesting a callback.

You can also call 087 222 7000 or email support@ikhokha.com