Make your move towards better

More than

R80 000

in prepaid vouchers sold per month by our biggest merchants.

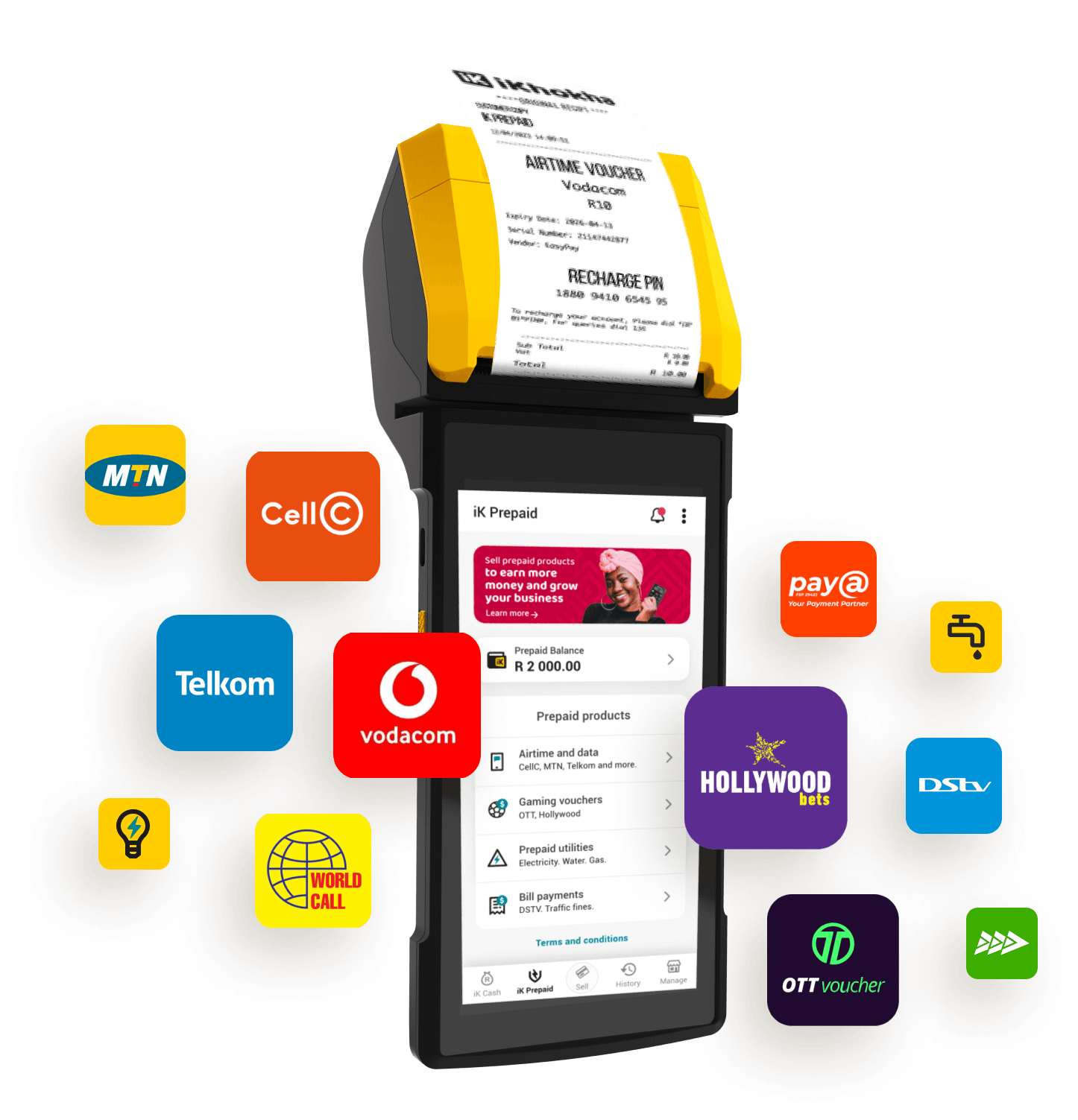

What products are available on iK Prepaid?

You can sell a range of digital products as well as accept several types of bill payments such as:

Airtime & data vouchers

Cell C, MTN, Vodacom, & Telkom

Water & gas vouchers

Vouchers to top-up your utilities.

Traffic fines

Pay traffic fines.

Hollywood Bets vouchers

Top up vouchers for online or mobile.

DStv bill payments

Monthly DStv account payments.

OTT vouchers

Digital cash vouchers.

Pay@ bill payments

Monthly account payments.

Electricity vouchers

Vouchers to top-up your electricity.

Easypay bill payments

Monthly account payments.

And many more

Avon, SFX, etc.

Businesses that love growing with iK Prepaid

Get started with iK Prepaid in 3 steps

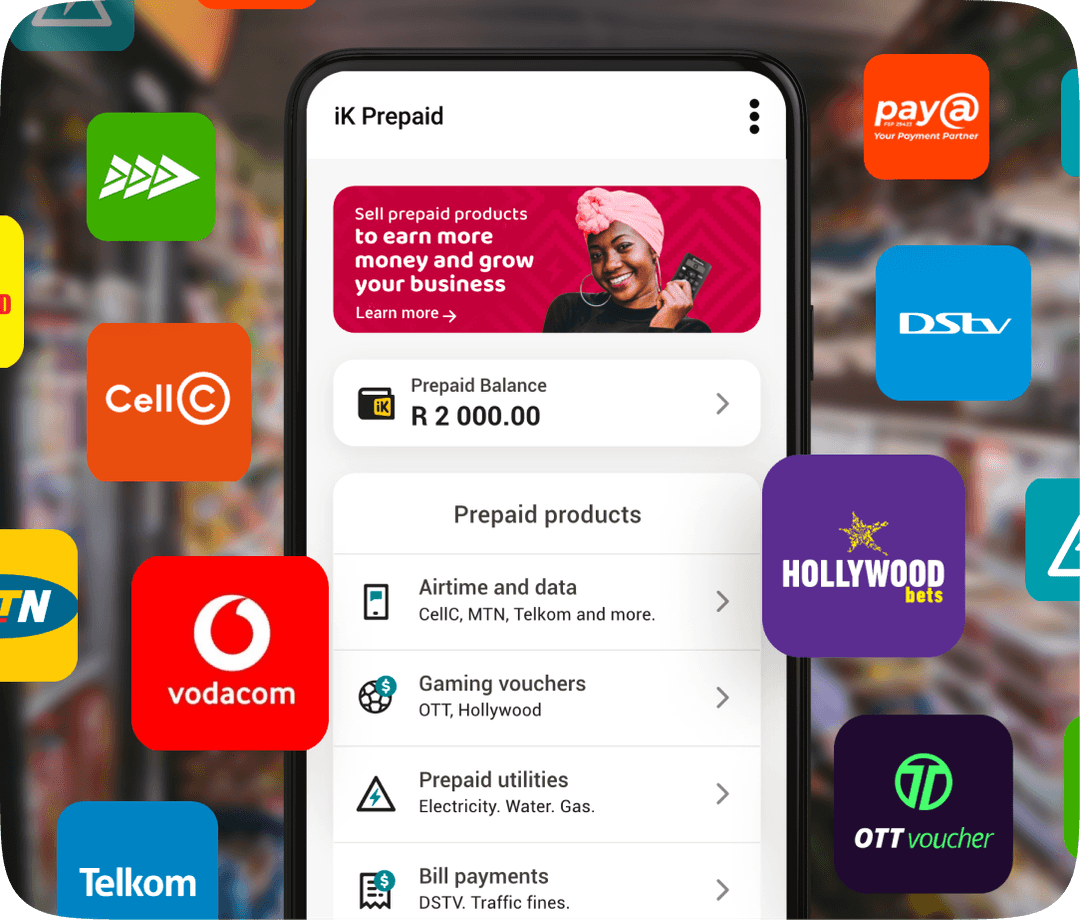

Get an iKhokha card machine or download the app

Buy your iKhokha card machine online, at a retail store, or by calling Sales.

You can download the iKhokha App from your app store.

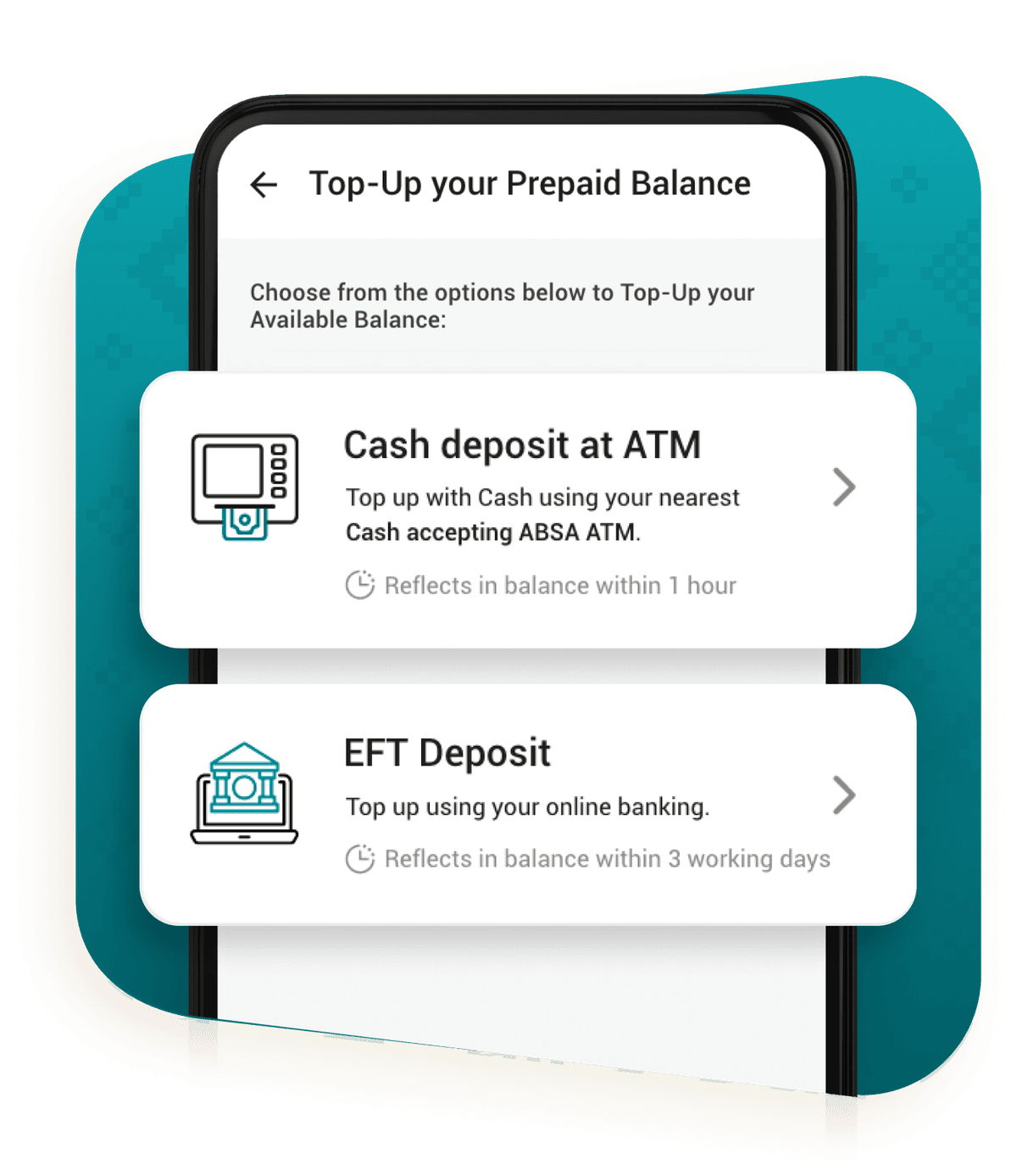

Top-up your prepaid balance

Simply deposit cash at an Absa ATM or by EFT from your bank account anytime.

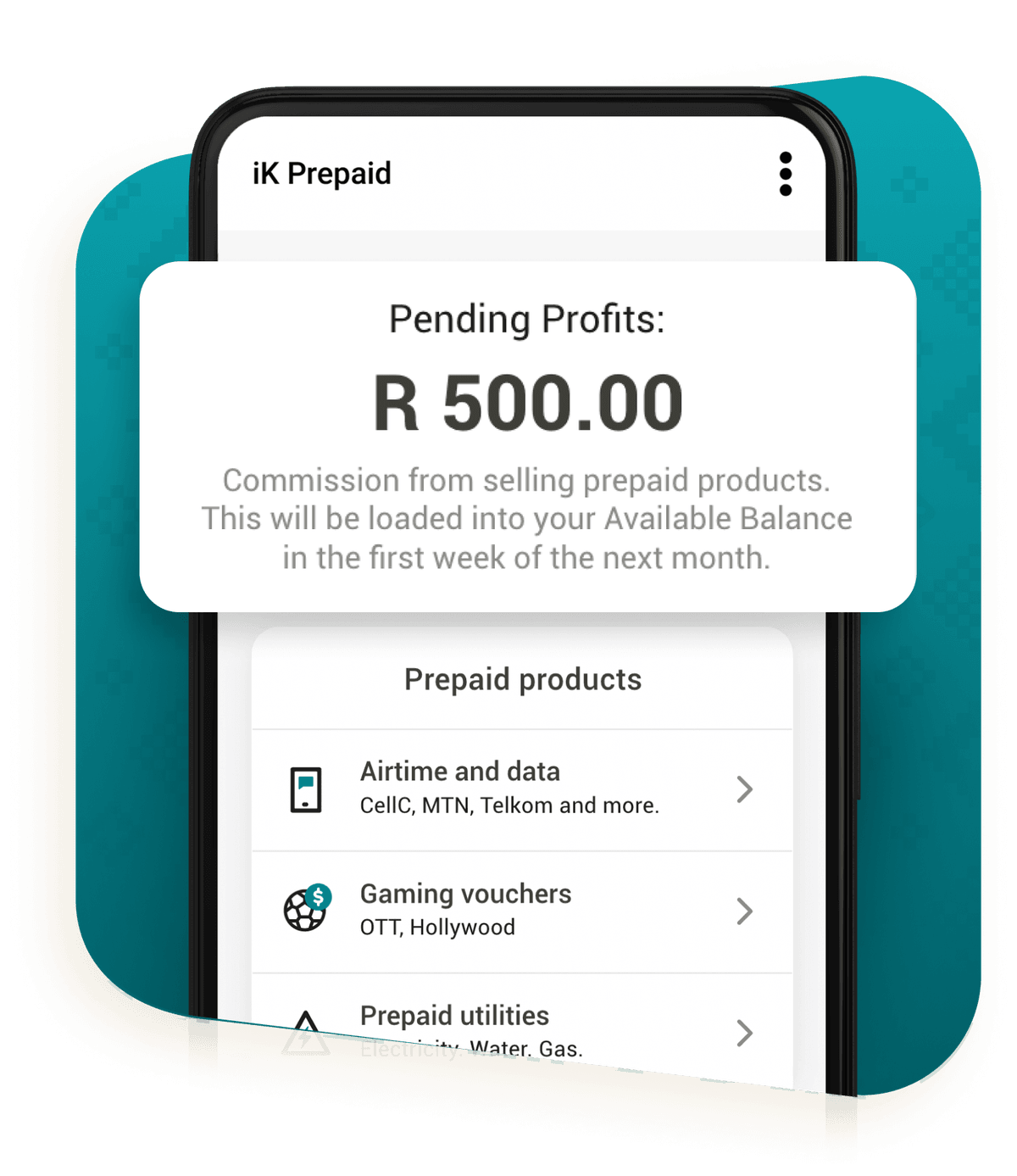

Start selling & track your earnings

Use the main menu of your card machine to sell airtime and other products. You can keep track of your profits with each sale on your card machine screen.

FAQs

iK Prepaid gives you the power to sell prepaid airtime, data, electricity vouchers, prepaid vouchers, and other digital products using your iKhokha card machine or your iKhokha App as an airtime and electricity machine.

An iKhokha card machine (if you need to sell printed vouchers) or the iKhokha App (if you only want to sell SMS vouchers). You will also need cash or a bank account.

After every sale, your profits are temporarily deposited in your "pending prepaid balance".In the first week of every month, your "pending prepaid balance" is deposited into your "available prepaid balance" so you can re-use your profits to buy more products.

Yes, iK Prepaid is designed to cater to businesses of all sizes, from small startups and sole proprietors to large enterprises.

Need help?

Get help instantly on WhatsApp, our chatbot Kelly, or by requesting a callback.

You can also call 087 222 7000 or email support@ikhokha.com